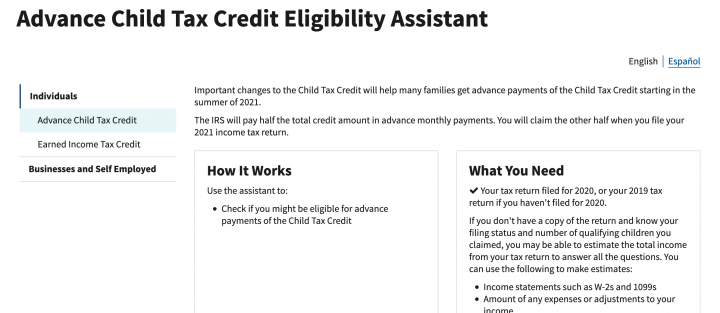

child tax credit portal pending eligibility

The full child tax credit for 2021 is 3600 per child up to age 6 or 300 a month and 3000 per child ages 6 to 17 or 250 per month. Payment Issues with the Monthly Child Tax.

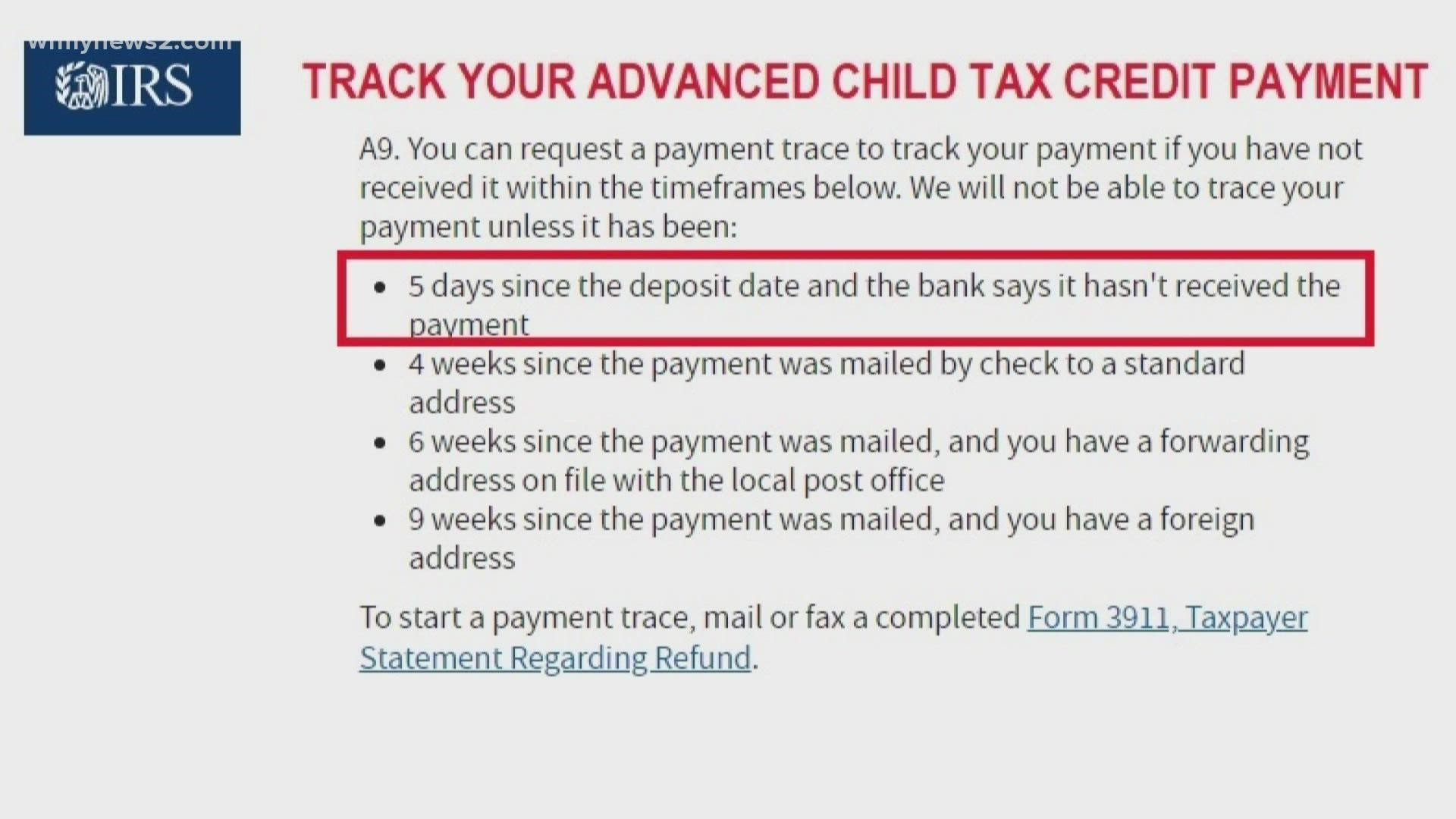

Are You Missing The September Child Tax Credit Payment Wfmynews2 Com

However you can claim the creditworth up to 3600 per childin 2022 by filing.

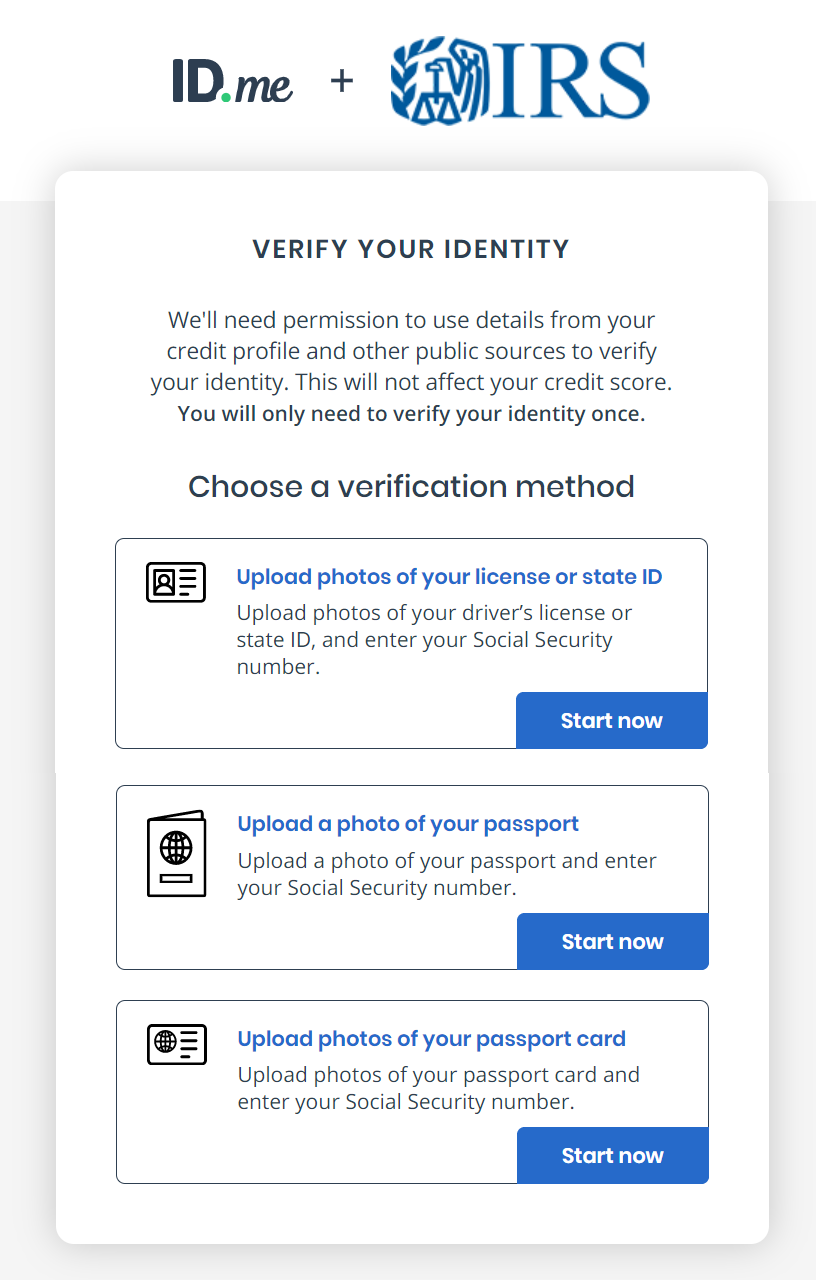

. I went back to pending eligibility and there is no answer to why she said. My 2020 return was processed but then went under review. If on the IRS website in Eligibility Status of your Child Tax Credit it says Pending your eligibility has not been determined.

You will not receive advance. The deadline to sign up to receive advance Child Tax Credits payments in 2021 was November 15 2021. The remaining credit can be claimed on your 2021.

Those who are not eligible for the higher. So i dont know if thats considered not processed or not but regardless they should be able to see. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased.

You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you. The maximum Child Tax Credit that parents can receive based on their annual income. In January 2022 the IRS will send you Letter 6419 to provide the total amount of advance Child Tax Credit payments that were disbursed to you during 2021.

In this blog post well explain everything you need to know. Youre not required to file an amended return to receive advance Child Tax Credit payments. Im listed as pending.

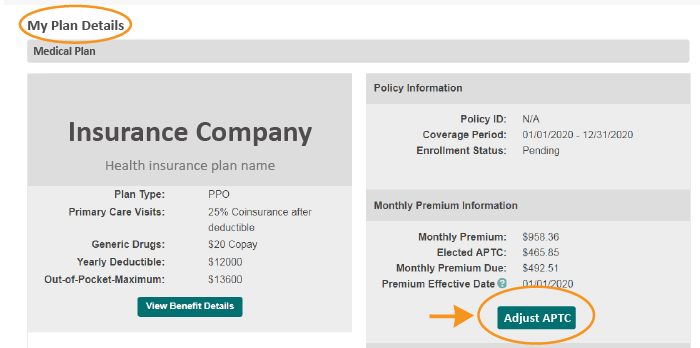

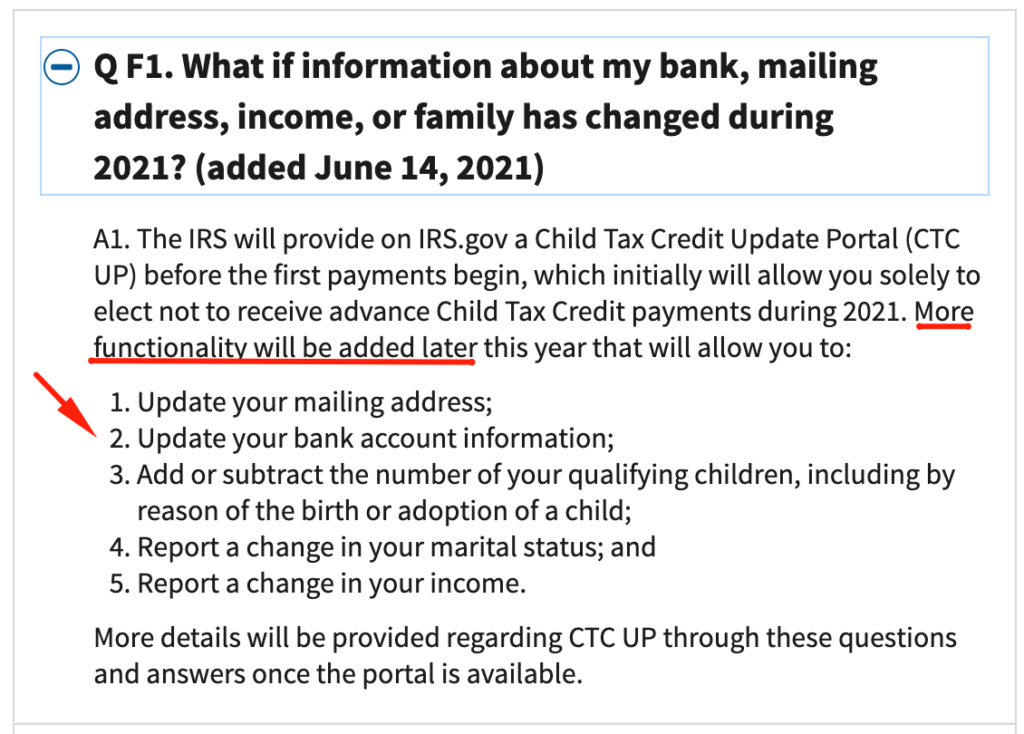

Got payment in August and September for 300 instead of 250 - I just assumed they were adding 50 every payment to make up for the missed initial. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. The Child Tax Credit Update Portal is no longer available.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual. If the child tax credit update portal returns a pending eligibility status it means the irs is still trying. The full child tax credit is 3600 per child up to age 6 or 300 a month and 3000 per child ages 6 to 17 or 250 per month.

Have been a US. If the portal indicates your payment is pending eligibility the IRS is reviewing your account to determine if you are eligible. The first stage will begin to reduce your child tax credit to 2000 if your adjusted gross income in 2021 is greater than 150000 for most couples filing jointly 112500 if you.

If youre wondering why your eligibility for the Child Tax Credit is pending dont worry. Amended and missed my first payment. As provided in this Topic E if the IRS has not processed your 2020 tax return as of the payment.

Hac News November 12 2021 Housing Assistance Council

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Irs Investigating Why Some Families Didn T Receive September Child Tax Credit

Irs Child Tax Credit Update No Payment Track August Check

Claimant Most Frequently Asked Questions Division Of Unemployment Insurance

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

Future Child Tax Credit Payments Could Come With Work Requirements

Child Tax Credits Deposited Friday Why Yours Possibly Did Not Come

Fourth Stimulus Check News Summary For Friday 9 July As Usa

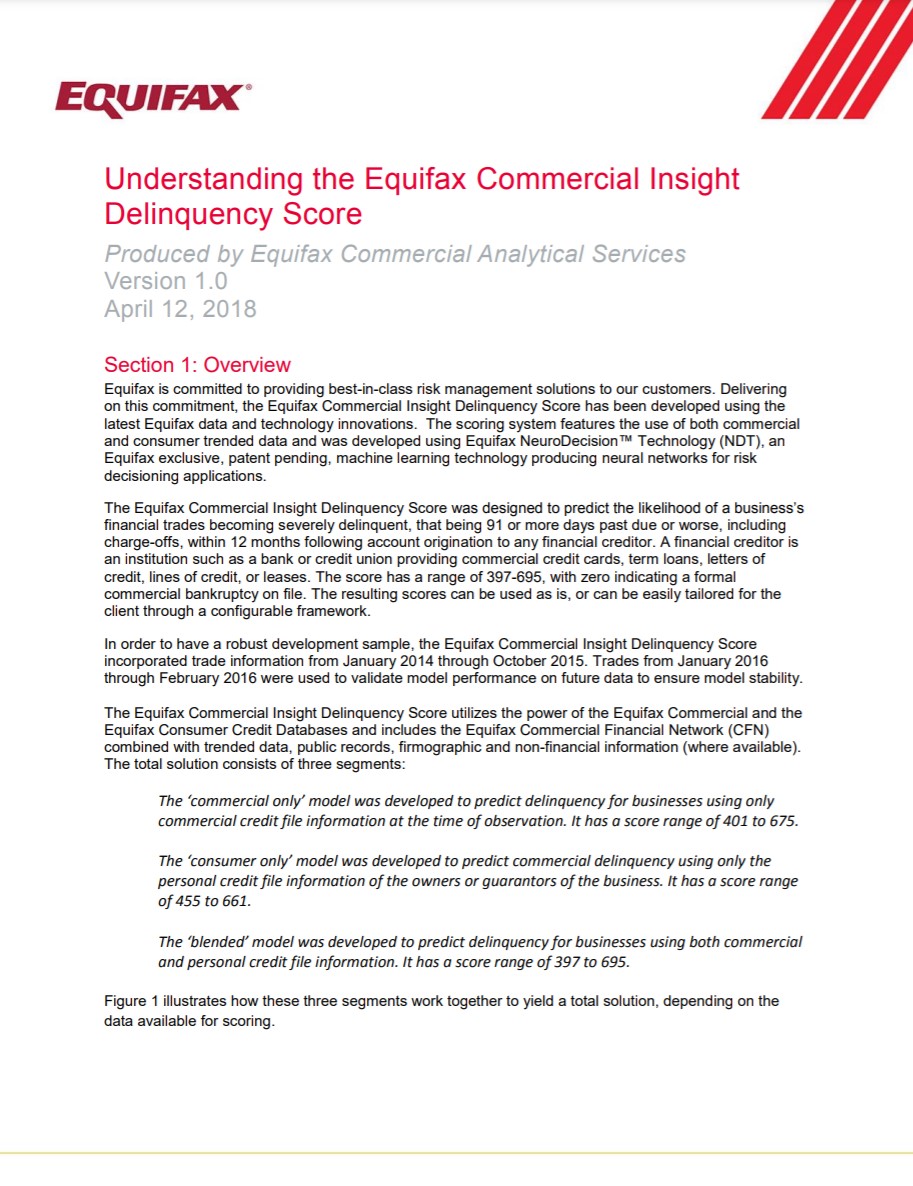

Commercial Insights Delinquency Score White Paper Equifax

Anybody Else S Showing This R Irs

Monthly Child Tax Credit Payments Have Ended And Their Future Is Unclear

Irsnews On Twitter A Reminder To American Families This Fall Irs Is Issuing Millions Of Advance Monthly Childtaxcredit Payments Through Dec 2021 If You Have Questions See The Answers We Ve Posted Online

Gobank Expecting A Child Tax Credit Payment For Eligible Recipients We Ll Get You Fast Access To Your Funds And Post Them To Your Account As Soon As We Receive The Instructions

Irs Investigating Why Some Families Didn T Receive September Child Tax Credit

Tools To Unenroll Add Children Check Eligibility Child Tax Credit

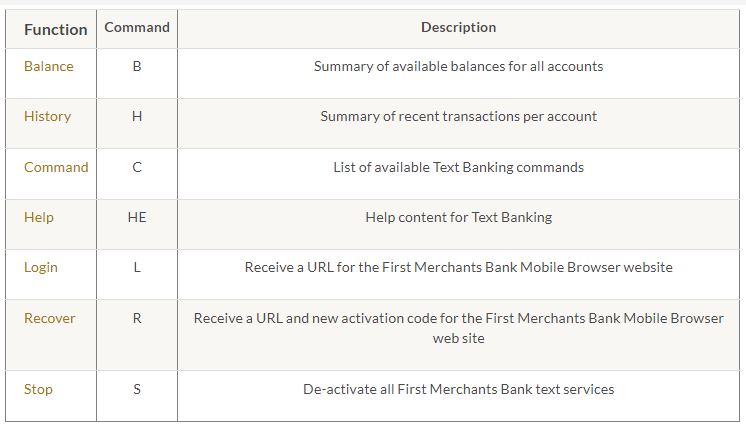

Frequently Asked Questions Faqs First Merchants Bank

Child Tax Credit Payment Delays Frustrating Families In Need The Washington Post